Chris's Special Market Dispatch - Friday, November 3, 2023

Our quick take: interest rate hikes are done, inflation is due south and investors are fearful – a wonderful mix for markets to rally.

A lot has changed this week, and it is noteworthy that we are now entering the markets’ seasonally strongest months of the year – November through April. On October 31, 2023, I finished updating my Take on the Week, an internal slide deck where I pull together all the evidence that I find surprising/compelling. In it, I quipped to my Raymond James colleagues: “Friends, …based on the evidence I am seeing, I am getting increasingly bullish – don’t let the Halloween spooks scare you out of your stocks 😊.”

Yes, September and October were rough months, but what is making me bullish? In bullet point fashion here goes:

- I believe we have hit the high in interest rates both on the long and short end of the curve. The U.S. Federal Reserve Board is done raising rates for this cycle and the next move will be down.

- Last month, the iShares 20+Year Treasury Bond ETF (TLT) had a 47% drawdown from its high-water mark during Covid…almost 50% off seems attractive to me. Note the significant bounce this week.

Charts courtesy of StockCharts.com

- Likewise, the 10-year U.S. Treasury Yield recently pegged the psychological 5% barrier and it seems buyers returned with a FOMO attitude – fear of missing out. It is at 4.7% as I write – the bonds got bid up and of course the yields fell. A side note for those participating in our Fixed Income Cheap and Cheerful strategy: you will be heartened to know that we locked up some +5% rates last month.

Charts courtesy of StockCharts.com

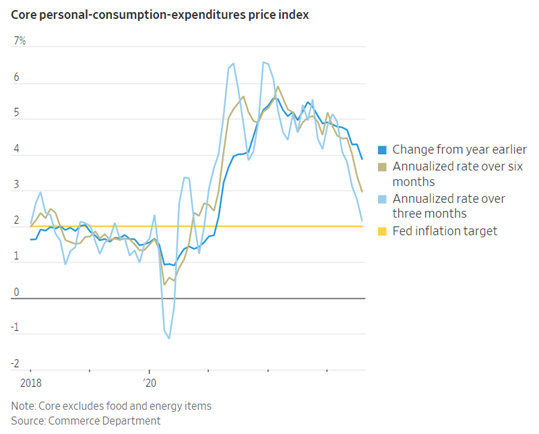

- As you know, the higher rates have been put in place to fight inflation and we are seeing the near-term inflation rate drop precipitously…for now. It is noteworthy that during the 1970s, inflation came in three distinct waves, with each wave being higher than the last. That may or may not happen this time. In the interim, I see the image below as encouraging. Note that the “annualized rate over three months” (light blue line) is dropping like a stone and is almost at the “Fed inflation target” (yellow line) of 2%.

- Yes, the economy is slowing, and investors are worried about a recession, and they have been worrying about it now for at least 18 months. Our take is, “surely it is priced in by now.” What isn’t priced in is the coming expansion.

- Fear is palpable and that is a great contrarian indicator – it reads bullish! To wit, the CNN Fear Greed Index was registering 29, approaching extremes on Halloween and hit Extreme Fear 19 during the month of October.

- Chris, where are you seeing pockets of value and what gives you pause?

- Energy (oil and gas) is back to generating huge cash flows and yet few investors have caught on yet. That seems to be changing - see The Globe and Mail – Cheaper Canadian oil and gas valuations lure potential U.S. buyers north.

- At the other end of the extremes, note that technology is at the bottom of the list and yet the top 10 stocks in the S&P 500 (8 are technology companies) make up 33.5% of its value. That number hasn’t been that high since the year 2000. Those of you with long memories will recall the dot-com crash.

- Between those two extremes, there are lots of great companies on sale. They tend not to be in the mega-company space, rather mid-size companies and smaller companie

Wrapping it up, as we closed out October the average stock on the NYSE was down 33% off its 52-week high. While I don’t have the metrics, I suspect Canada wouldn’t be much different. The bottom line is 1/3 off seems interesting to me. We look forward to the months ahead.

The information contained in this report was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete and it should not be considered personal tax advice. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views expressed are those of the author and not necessarily those of Raymond James. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. This provides links to other Internet sites for the convenience of users. Raymond James Ltd./Raymond James (USA) Ltd is not responsible for the availability or content of these external sites, nor does Raymond James Ltd/Raymond James (USA) Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd/Raymond James (USA) Ltd adheres to. Raymond James Ltd., Member—Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd. is a member of FINRA/SIPC.