The Quarterly Opportunity Update

April 13, 2023

Q1 2023

BY: Chris Raper, CFP®, CIM®

Audio Version

Introduction – The Skinny

The Markets – Key Observations Post the U.S. Banking Crisis

Q1 2023 Performance Recap – Aspira Wealth Strategies

Banks versus Oil Producers – A Canadian Perspective

Key Takeaways & Behaviour That Has Served Us Well

Postscript - Prospective Clients - The Aspira Wealth Approach

Introduction – The Skinny

Hi, this is Chris Raper, Wealth Advisor and Portfolio Manager with the Private Client Group of Raymond James Ltd. & co-founder of Aspira Wealth. Welcome to The Q1 – 2023 Quarterly Opportunity Update, published and recorded on audio for you on Thursday, April 13, 2023.

Let’s start with The Skinny – here is what we are going to cover today. I will start at the 50,000-foot level, The Markets and cover off our key observations, post the collapse of Silicon Valley Bank and the reverberations thereof. In short, we need to answer the question, are we about to go into a systemic banking crisis and thus, severe recession?

We will then narrow our focus, say to the 10,000-foot level, and I will bring you up to date on where we landed for the first quarter of 2023 within the Aspira Wealth internally managed strategies.

From there, we will move to 5,000 feet, where we will see a gaping divergence between Canada’s Banks versus Oil Producers and why we favour one over the other.

After that, I will recap the highlights and remind us of the Investor Behaviour That Has Served Us Well over the years, which is apropos given the heightened volatility we have seen lately.

Finally, and in postscript mode, for the benefit of prospective clients, I will walk you through Our Approach which unpacks the Aspira discovery process, where we both want to answer the question, is there a fit? In a nutshell, we start with you and your story and we dive into your do, have, and legacy aspirations. Only then can a solid foundation be laid.

In terms of legal requirements, there are three things to note:

- The opinions that are expressed on this recording are mine. They may differ from those of Raymond James Ltd. / Raymond James (USA) Ltd.

- Raymond James Ltd. is a member of the Canadian Investor Protection Fund and Raymond James (USA) Ltd. is a member of Securities Investor Protection Corporation. That is a good thing. If you are interested in those details, please ask me or any one of our relationship managers the next time we speak.

- The transcript of this recording provides links to other Internet sites for the convenience of users. Raymond James Ltd. / Raymond James (USA) Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd. / Raymond James (USA) Ltd. endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd. / Raymond James (USA) Ltd. adheres to.

I also want you to recognize that some of the things I am going to say today are going to be proven wrong. It is an inevitable part of this business. It is also important to recognize that you don’t have to be right all the time to do well. You just have to be more right than most or, conversely, less wrong than most.

Regarding investment jargon, when I say I am bullish, it means I expect things to go up. When I say I am bearish, it means I expect things to go down. Likewise, north means up and south means down. When I speak about rent cheques, I am speaking about income, primarily dividends. If you catch me using industry jargon beyond that, I invite you to call me out.

The Markets – Key Observations post The U.S. Banking crisis

As most listeners/readers will know, the collapse of Silicon Valley Bank over the weekend of March 11-12 saw equity markets go into panic sell mode on Monday, March 13. Before the close of business that day, we released our Aspira's Special Market Dispatch - Capitalizing on the Chaos missive, giving you our take and letting you know we were concentrating on taking advantage of the opportunities created.

Now, some four weeks later, the critical question we need to answer is this - was that collapse restricted to a few banks with poor risk management or is the entire banking system in serious trouble? If it is the former, the economy and, thus, stock values will likely continue to muddle on in an upward trajectory over time, but if it is systemic, the economy can quickly grind to a halt as we saw in the 2008 banking crisis.

While we will only know the answer for certain in the fullness of time, there is much to be inferred by the post-crisis market data. So, let’s take stock:

Dr. Copper (the price of copper) closed out at $4.00 and change yesterday. Yes, well off the high-water mark of $4.35 per pound in early January, but more importantly, it did not break to new lows as Silicon Valley folded and their shareholders got wiped out.

The inference is twofold:

- The shiny red metal that goes into virtually every manufactured good in the world is still pointing to global expansion, albeit in muddled fashion.

- Within the world’s manufacturing economies, the recent banking run is not systemic.

Charts courtesy of StockCharts.com

Turning to our leading economic indicators for the world’s service-based economies, the Philadelphia Semiconductor Index ($SOX) actually spiked to six-month highs during the banking crisis but that phenomenon also coincided with a lot of excitement around ChatGPT and the promise of an Artificial Intelligence (AI). Accordingly, difficult to read the inference other than it does support the idea that the banking crisis is not systemic.

![]()

Charts courtesy of StockCharts.com

Looking at the energy complex, supplies remain tight and it is apparent that OPEC+ (the Organization of the Petroleum Exporting Countries + Russia and a few minor producers) decided it was not tight enough. While the threat of a systemic banking crisis saw $WTIC scratch a fresh 52-week low of sub $65 USD/BBL, the mere threat of a 1 million bbd cut in daily output on April 2, saw the price spike from ~$75 to $80 pretty much instantaneously and it has resided there since then. While that action is no doubt welcome news for our oil producers, I believe what is more important is how quickly the oil market recovered before the announcement. That $65 to $75 move infers no systemic banking crisis. The economy continues to muddle along.

Charts courtesy of StockCharts.com

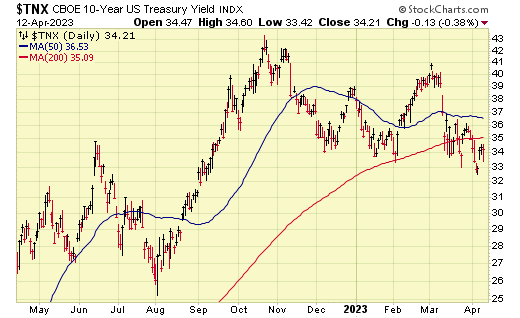

$GOLD is back in the spotlight with some considerable tailwinds at its back. Plausible positives include a weaker USD$ and lower interest rates as inflation eases in the near term. On the inflation front, just yesterday, we got the March 2023 read with the U.S. inflation rate falling to five per cent year over year, versus six per cent in February 2023 and a country mile from the +9 per cent back in June of 2022.

The fly in the ointment for me is that we are seeing inflation remaining stubbornly high in the services sector and that makes up ~75 per cent of the economy in both the U.S. and Canada. Thus, it is not hard for me to paint a picture where the U.S. Fed backs off the inflation fight and by the time it recognizes that there is a real and growing problem, we are into the U.S. November election cycle where they will be loaf to act. Such an outcome would obviously be a push for gold and gold producers. The other observation I have is that if we were about to slide into a systemic banking crisis that would trigger a severe recession and severe recessions are disinflationary, it would create a real headwind for gold. That’s simply not happening as I speak.

Charts courtesy of StockCharts.com

Charts courtesy of StockCharts.com

Finally, our investment sleuth, Alex Vozian, CFA, pointed out to me that the Baltic Dry Shipping Index has just regained its 200 MA and it has been under that level for 16 of the past 17 months. That is a long time by historical standards and with the $BDI now moving north, it speaks to improving demand for movement of raw materials and thus, manufactured good producers must be seeing increased demand, i.e. no serious recession.

Charts courtesy of StockCharts.com

Wrapping this section up, it is very hard for us to make a case for a systemic banking crisis and thus, a severe recession. Employment is still growing, as is the labour participation rate. Here in Canada, resource prices are high by historical standards and we are a resource-based economy. Interest rate increases have eased somewhat.

In conclusion, we don't see a systemic banking crisis on the horizon and the pending recession that everybody has been talking about for the last year may well be behind us, not in front of us. If the evidence changes, then we will have to change. For today, that’s how we see it.

The Q1 2023 Performance Update – Aspira Wealth internally managed Strategies

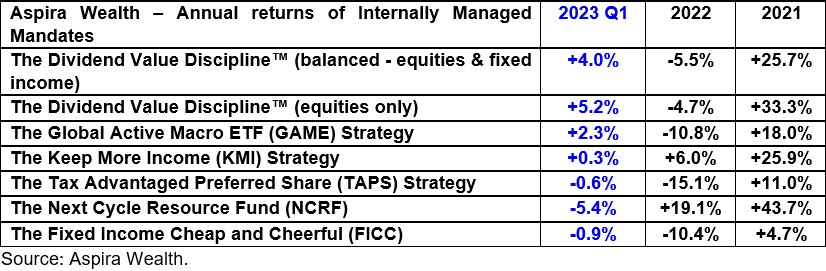

The big picture is that most of our equity and balanced strategies pegged in with positive results on the quarter, whereas our fixed incomes were down less than one per cent. Admittedly, those results were slightly subpar vis-à-vis the market indices, but we need to put that in perspective. We are talking a 90-day window and we just came off two years of outperformance for most of our strategies.

On a name-by-name basis, the results are as follows:

Sidebar disclaimers:

- Those return figures do not include the returns from the non-discretionary side of your accounts. For most of our clients, that means guaranteed investment certificates (GICs) and high interest savings accounts (HISA). Our objective when owning the same is to make sure you never have to sell securities in a down market to meet your cash flow requirements.

- The above numbers are only applicable to accounts we manage within the Raymond James Ltd. (Canada) platform. Our cross-border clients who have accounts domiciled at Raymond James USA Ltd. will have different results, in large part due to currency swings.

- The timing of cash flows and our buy-only approach for new money translates to considerable variability in actual client experience. For your awareness, the March 31, 2023 progress reports are now up on your client login site. If you are not using that site, please reach out to us so we can get you up and running. We will kill less trees, it has 24/7 access and is far more secure than email.

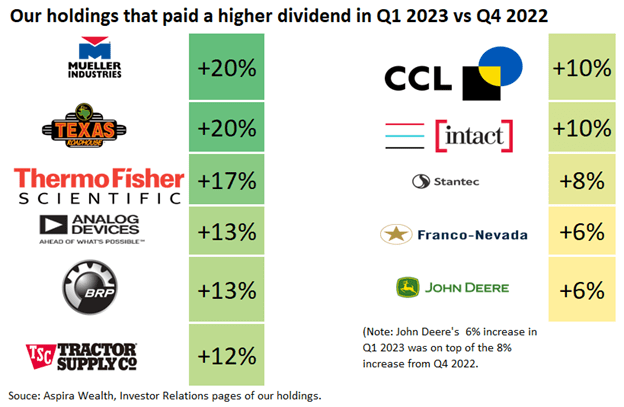

Turning to our rent cheque growth, aka dividends, we continue to see robust numbers.

The thesis that has served us well over the years is simply this - earnings growth drives dividend growth, growing rent cheques (dividends) are the glue that holds us in the market during the rough times. Remaining invested, or better yet, adding money during the rough times, is what allows us to capitalize on the market’s long-term upside. In the meantime, those dividends mean we get paid to wait.

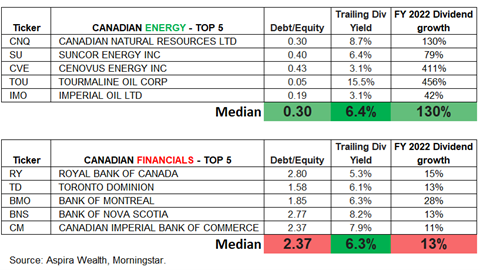

Banks Versus Oils – A Canadian Perspective

Given the recent turmoil in the U.S. banking system, we have understandably had some inquiries on what our perspective is for Canadian banks. Let me start with the fact that I am not concerned that any of our major banks are going to fail in a manner similar to Silicon Valley Bank. The real question for us is, are they likely to be superior investments in the months and years ahead – they certainly have been for the last 15 years.

Investing is a relative proposition – every decision is weighed against the plausible alternatives. To make good decisions, we have to recognize where we are at, within the long-term cycle. Our observations on banks are that they have done exceedingly well, post the 2008/09 financial crisis. As rates moved south, loans were easier to service, consumers and businesses took on more debt, their security, largely real estate, increased significantly in value and just when it looked like their borrowers were about to go into a massive Covid-induced recession, central bankers lowered rates to effectively zero and then sent out free money to make the payments. I mean, could it get any better? Today, we have a lot more angst in the system – borrowers have mortgages coming due and need to refinance at significantly higher rates – it is not unusual for younger borrowers to move from 30 per cent debt service on their homes to 70 per cent. The real estate values are less certain, and I am hearing anecdotal evidence that building-related tradespeople are having a difficult time finding work.

Now, let’s reverse gears and think through the last 15 years of trying to operate an oil company. The product you produce went from a high in 2008 of $150 USD per bbl to sub-zero during the 2020 Covid-induced collapse. In terms of attracting investors, nobody would talk to you, let alone invest any new capital. Thus, you kept pumping what oil you could, but all oilfields decline without capital investment. Pile on top of that, all the institutional investors who decided it was better to have Russia and the Saudis produce the world’s oil instead of our domestic producers as they pursued their ESG initiatives. That selling only compounded the problems of insufficient investment in production. Now, let’s consider the European wakeup call on its misplaced energy policies and the fact that they were only saved by China being in recession and an unusually warm winter. Make no mistake, the world has an oil supply problem. Again, witness what just happened when OPEC+ announced their intention to cut 1M bblpd.

So, narrowing our focus to Canada, banks versus oils, which one would you choose to overweight in the months and years ahead?

Let’s look at some actual corporate metrics, the debt load of Canada’s big five energy producers is almost non-existent (and that is somewhat laughable because the banks won’t lend them much anymore) whereas banks are highly-leveraged animals. Their debt-to-equity ratios are significantly higher but even that ratio understates the banks’ leverage. If we move to the industry standard Tier 1 capital ratio, we would see that our banks have somewhere between $10 to $13 at risk for every $1 in equity capital.

Yes, the dividend yield is about the same for both sectors, but the dividend growth favours the oil producers by 10-fold on a look back basis. If it is even a quarter as good in the years ahead, we will be happy campers.

Bottom line, when I reflect on the end-user of each sector’s product, I see the banks have a shortage of qualified borrowers, while energy consumers have a shortage of oil, which will ultimately only be resolved by price. We favour the oil producers by a wide margin. That’s a wrap on this section and let’s move to the key takeaways.

Charts courtesy of StockCharts.com

Key Takeaways – investor behaviour That has served us well

Here are the highpoints of what we have covered today – our economic indicators are not pointing to a systemic banking crisis or a severe recession. Dr. Copper is strong, the semi-conductor space is okay, and gold seems to be more worried about inflation as opposed to recession. Our view is that the recession talk is getting long in the tooth just as the Baltic Dry Shipping Index points north and employment continues to grow. As for Aspira results, still largely positive at quarter end and yes, somewhat subdued, but that is a 90-day window on the back of two years of outperformance. The rent cheque growth continues, and we believe we are well positioned for the future. In banks versus oils, we see a lot more upside in oils.

Finally, to the investor behaviour that has served us well, it goes back to my missive on March 13, 2023 – Capitalizing on the Chaos. I quote, “Undoubtedly, some will panic, and their actions will permanently impair their wealth. Others will work up the intestinal fortitude to stay calm and look for opportunities to capitalize on the chaos. We are concentrating on the latter…..So, here is how to help yourself today – scratch around and find some cash, turn over the couch, go through your old jeans and check your account balances at the bank – more is better! ” unquote. Here we are, just one month later, and those that sold have deep regrets – those that held are glad they did and those that sent money are happier still.

That brings us to a close for this edition of The Quarterly Opportunity Update. A reminder, if you are being introduced to us by way of this recording, then the postscript is for you. Thank you for taking the time to listen. Please don’t keep us a secret - if you have people in your life who you think might benefit from these missives, please forward them as you see fit, or even better introduce us via email and we will run with it from there. This is Chris Raper, co-founder of Aspira Wealth, wishing you and your loved ones all the best. Good day and may God bless, from Victoria B.C. on Thursday, April 13, 2023.

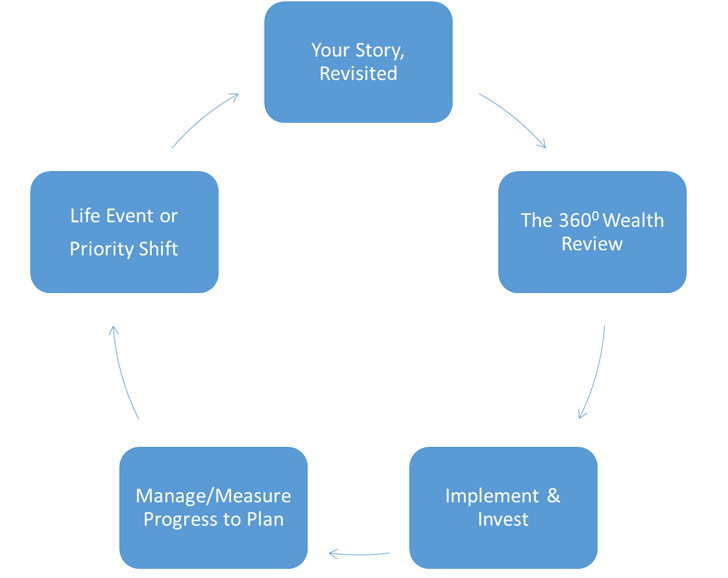

Postscript I – Our Approach

While this recording has been focused on investments, that is not where we start with new relationships. We start with your story, and we revisit it often. Knowing where you came from and what you want the future to look like – your do, have and legacy ambitions – is the foundation for building a solid client/wealth advisory relationship. Our first order of business is to listen, seek clarity and then document your ambitions for the future. We call it, Your Story, Revisited.

From there, we complete a 360⁰ review of all relevant investment, tax/estate and insurance documents in an effort to identify gaps/risks to the future you envision. When we identify holes, we have a discussion about how we might fill those holes.

Then, and only then, do we get into a discussion on the investment allocation. We will address your liquidity, income and growth requirements/desires and introduce you to the tax-smart investment strategies to meet those needs.

After we invest, it is a matter of manage and measure – we report regularly and when life throws you the inevitable curve ball or your priorities change, it is back to revisiting your story.

In summary, we learn about you, your family, your finances and what your ideal future looks like – the things you want to do, the things you want to have and the legacy you want to leave. We identify the structural risks and how we see us mitigating them. We paint a go-forward picture with a worst case analysis of the costs involved.

Generally speaking, we are looking to establish relationships with new clients that have north of $1 million in investable assets, but please understand that we are a lot more interested in where you are going than where you are. If you have a credible plan to get to that number, say within a three to five year period, we are interested in meeting with you.

So…if that process sounds engaging, I invite you to call and book some time. If you’d like further information, including access to our quarterly communication pieces, you can check us out on the web at www.aspirawealth.com and send us an email from there.

The information contained in this report was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete and it should not be considered personal tax advice. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views expressed are those of the author and not necessarily those of Raymond James. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd., Member—Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd. is a member of FINRA/SIPC.