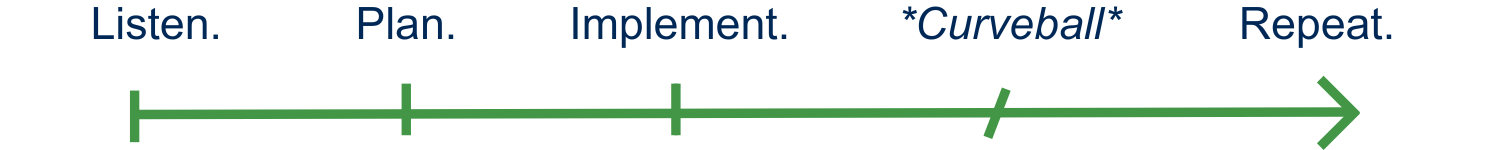

CROSS BORDER WEALTH SPECIALISTS: financial & retirement planning

PERSONALIZED FINANCIAL PLANNING, WITH CROSS BORDER EXPERTISE

This is where two of our core specialties collide - our 360° Wealth Strategy financial planning and our dedicated team of Cross-Border Specialists. Everyone needs a living, breathing financial plan, but when it involves both sides of the border, you need an expert. We're happy to say, that's us!

CROSS BORDER FINANCIAL PLANNING WITH A TEAM APPROACH

Meet our two Wealth Advisors, Eileen and Chris. With their diversity of generations, perspectives, and experiences, Eileen and Chris work closely with clients in their financial planning and retirement planning.

Starting her career as a Wealth Advisor in the U.S. and now our lead Cross Border Advisor, Eileen provides insightful guidance to our cross border clients from her own first-hand experiences on both sides of the border.

Chris functions as the team mentor for all things Aspira Wealth, bringing together the people and pieces to ensure we are set up to cover our clients’ needs.

SPECIALIZED CROSS BORDER FINANCIAL PLANNER & RETIREMENT PLANNING COUNSELOR

Working in tandem with Eileen is the craftsman of all our cross border financial plans. Additionally, Clarke is a Chartered Retirement Planning Counselor™, which means he is an expert on the intricacies of U.S. retirement planning. This encompasses retirement savings accounts - 401(k)s and Individual Retirement Accounts (IRAs), social security benefits, and integrated tax and estate planning solutions. When it comes to cross border financial and retirement planning - Clarke is an invaluable asset!

TOP FINANCIAL PLANNING CONCERNS FOR U.S. CITIZENS/GREEN CARD HOLDERS MOVING TO CANADA & HOW WE HELP

KEEP YOUR 401(K)/IRA ACTIVELY MANAGED IN CANADA

What do I do with my 401(k)/IRA when I move to Canada? When moving to Canada, a change of address typically prohibits your existing advisor from keeping you as a client. This results in your accounts being frozen, but there is a solution. If you rollover your account into a Rollover IRA, it can be actively managed from Canada. This is effective for your 401(k), or other employer sponsored retirement plan, such as a 403(b).

With this rollover, your account can continue to be managed and invested in a manner that is in line with your overall objectives, on a tax-neutral basis. If you primarily invest in U.S. securities, and want to keep both the holdings and any dividends in USD currency, this will be essential to avoid costly conversion fees, and unfavorable foreign exchange rates. Note that it is against regulation to use an improper address as a way of avoiding this transition.

RECEIVE U.S. SOCIAL SECURITY BENEFITS WHILE IN CANADA

Can I receive U.S. Social Security benefits while in Canada? As long as valid contributions were made to Social Security and you meet the eligibility requirements, the answer is yes! This is true even if you are a Canadian Citizen. Canadian Citizenship is not a limiting factor to receiving Social Security benefits while living in Canada.

Social Security brings with it many valuable benefits, such as social security for spouses. This can be very useful if one spouse has never contributed or has a low benefit. This spousal benefit can be up to 50% of the worker’s primary insurance amount.

The Social Security Fairness Act was signed into law January 5th, 2025, ending the Windfall Elimination Provision (WEP). This change eliminated the reduction of WEP from the collection of another pension, such as a non-covered pension from an employer or the Canada Pension Plan (CCP). This means more money in retirees’ pockets, regardless of your location.

BOOK YOUR DISCOVERY MEETING

Whichever side of the border you find yourself on, we make your cross border complexities simple. Book an introductory meeting with your new advocate today or learn more about how we set our clients up for success, across generations.

Raymond James (USA) Ltd. All rights reserved. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. This website may provide links to other Internet sites for the convenience of users. RJLU is not responsible for the availability or content of these external sites, nor does RJLU endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy that RJLU adheres to. Investing in foreign securities involves risks, such as currency fluctuation, political risk, economic changes, and market risks.

- Victoria 1175 Douglas Street Suite 1000 Victoria, BC V8W 2E1

- T +1.250.405.2434

- Map & Directions

- Map & Directions

- Calgary 525-8th Ave SW Suite 4100 Calgary, AB T2P 1G1

- Map & Directions

- Map & Directions

- Edmonton 10060 Jasper Avenue Suite 2300 Howard Place, Tower 1 Edmonton, AB T5J 3R8

- Map & Directions

- Map & Directions

© 2026 Raymond James Ltd. All rights reserved.

Privacy | Advisor Website Disclaimers | Manage Cookie Preferences

Raymond James Ltd. is an indirect wholly-owned subsidiary of Raymond James Financial, Inc., regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund.

Securities-related products and services are offered through Raymond James Ltd.

Insurance products and services are offered through Raymond James Financial Planning Ltd, which is not a member of the Canadian Investor Protection Fund.

Raymond James Ltd.’s trust services are offered by Solus Trust Company (“STC”). STC is an affiliate of Raymond James Ltd. and offers trust services across Canada. STC is not regulated by CIRO and is not a Member of the Canadian Investor Protection Fund.

Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Statistics and factual data and other information are from sources RJL believes to be reliable, but their accuracy cannot be guaranteed.

Use of the Raymond James Ltd. website is governed by the Web Use Agreement | Client Concerns.

Raymond James (USA) Ltd., member FINRA/SIPC. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. | RJLU Legal