The Quarterly Opportunity Update – Transcript

Q1 2022

BY: Chris Raper, CFP®, CIM®

- Track #1: Introduction – The Skinny

- Track #2: The Markets – Disruption!

- Track #3: Accessing Canada – Adaptive Tactics & The Q1 Recap

- Track #4: 7 Provocative Questions & A Shifting World Order

- Track #5: Postscript I – Our Approach

- Track #6: Postscript II – The Dividend Value Discipline™ Methodology

Track #1: Introduction – The Skinny

Hi, this is Chris Raper, Wealth Advisor & Portfolio Manager with the Private Client Group of Raymond James Ltd. & co-founder of Aspira Wealth. Welcome to The Quarterly Opportunity Update, which was recorded for you on Thursday, April 7, 2022. This recording is accompanied by a transcript complete with charts that provide evidence to the issues I will be speaking on – I believe you will get a lot more out of the audio by referencing the transcript.

You are listening to Track # 1: The Skinny, where I give you the high points on what we are going to cover today.

On Track # 2: The Markets – Disruption! – I am going to kick off the track with an update on our leading economic indicators and then update you on the commodities complex, where a lack of investment during the Covid pandemic, coupled with global disruptions, are causing prices to surge. Then I will speak to the history of such disruptions, because it helps us understand the likely course of future events, and how we intend to capitalize on those developments.

On Track # 3: Accessing Canada – Adaptive Tactics & The Q1 Recap, I will spend some time walking you through how our adaptive tactics have pushed us, correctly I might add, into more resources exposure both within our core investment strategy, The Dividend Value Discipline™ and our other in-house complementary strategies. Then we will wrap it up with a recap of our 1st Quarter 2022 results and compare that to where we landed for 2021.

On Track # 4: 7 Provocative Questions & A Shifting World Order, is where I am going to address how our central government policy decisions often have unintended consequences that are most often not evident when those decisions are made. I will start with the recent past and move to present day, and then look into the future and consider some possible outcomes. Fair warning - the questions I will pose are going to be jarring and the possible outcomes are not comfortable, but just because we may not like the answer, does not mean that it won’t happen. Keeping an open mind is the first step in protecting and growing your wealth.

Track #5: Postscript I – Our Approach is for the benefit of prospective clients. It will give you some insight into the new client process through which we walk interested parties. Spoiler alert – it starts with you and your story - our approach is tailored to your “do, have, and legacy” ambitions. In short, we need to understand your aspirations before we can help you achieve them.

On Track #6: Postscript II is where I walk you through the methodology and return objectives of our core program, The Dividend Value Discipline™. If you have an interest in the specifics of our core investment process, you will probably get a lot out of it – if that’s not you, you may want to give it a pass.

In terms of legal requirements, there are three things to note:

- The opinions that are expressed on this recording are mine. They may differ from those of Raymond James Ltd.

- Raymond James Ltd. is a member of the Canadian Investor Protection Fund. That is a good thing. If you are interested in those details, please ask me or any one of our relationship managers the next time we speak.

- The transcript of this recording provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd. endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy to which Raymond James Ltd. adheres.

I also want you to recognize that some of the things I am going to say today are going to be proven wrong. It is an inevitable part of this business. It is also important to recognize that you don’t have to be right all the time to do well. You just have to be more right than most or, conversely, less wrong than most.

Finally, regarding investment jargon, when I say I am bullish, it means I expect things to go up. When I say I am bearish, it means I expect things to go down. Likewise, north means up and south means down. When I speak about rent cheques, I am speaking about income, primarily dividends. You may hear me using the term “disruptor”, which is our moniker for those companies that are disrupting or re-inventing the way business is done in their particular market and are thereby able to grow at rates far faster than the rest of the economy. Think of Wal-Mart 20 years ago and Amazon today. You may also hear me use the term “aggregator”, which is our moniker for those companies that have a systemized approach to acquiring smaller competitors as a means to fuel their growth. That growth is the path to increasing dividends or, in our language, growing rent cheques. If you catch me using industry jargon beyond that, I invite you to call me out. Send an email to the office and the team will let me know, usually with considerable gusto!

That’s a wrap on the skinny, and off we go to Track #2.

Track # 2: The Markets – Disruption!

Starting with our leading economic indicators, Dr. Copper, that shiny red metal that goes into virtually every manufactured good in the world and thus our vector for the world’s manufacturing economies, hit an all-time high north of $5.00 per lb shortly after Russia’s invasion of Ukraine. This morning, it was pegging in at $4.75 per pound, and is seemingly in an upward trajectory, indicating that our global economic expansion is still advancing – at least as far as manufacturing goes. The Global X Copper Miners ETF (COPX) is showing a similar pattern, i.e. investors believe that these higher prices are here for the foreseeable future.

Charts courtesy of StockCharts.com

When we turn our attention to the Philadelphia Semiconductor Index ($SOX), which is our vector for human ingenuity based economies, we see the price of semiconductor stocks are reflecting a pattern of lower highs and lower lows; ergo, it is suggesting slower growth ahead for our service based economies and begs the question, could it turn negative. Put another way, are we heading for a recession or just a slowdown?

Charts courtesy of StockCharts.com

When we see that kind of action in the $SOX, we go looking for other evidence to corroborate or refute it. An obvious one is the Dow Jones Transportation Index – if the economy is slowing, it tends to show up in transport stocks - the planes, trains and trucks – and there too, you can see a pattern of lower lows and lower highs; it is forecasting a slowdown. Uber Freight’s head, Lior Ron noted that spot trucking rates dropped 10% to 20% in the last couple of months as new trucks are registered and drivers try to cash in. The good news is that this is going to help some of our supply chain problems. Globally, the Baltic Dry Shipping Index has been dropping as well.

Charts courtesy of StockCharts.com

Add it all up and you have a global economy that is being severely disrupted by record high prices in life’s most basic necessities. Ultimately, the cure for high prices is high prices because they incentivize producers to produce more – the Uber example I just cited is a clear example.

Turning to commodities, let’s be reminded that their supply response typically comes in fits and starts, and it can take years to play out. By way of example, it normally takes 10+ years from the time you discover a new copper deposit to turn it into a producing mine. Furthermore, we have some special circumstances this time around when it comes to oil and gas – the ambitious environmental agenda amongst western governments has left the world thirsting for energy, and the only providers of increased production are a tough bunch of thugs who don’t give a rip about the environment. Witness Germany’s aggressive wind and solar push has left them dependent on Russian oil and gas. Furthermore, Canada can’t help much because we killed virtually every pipeline and LNG plant proposed and there is not a public company in its right mind that will make another attempt. The US is in a similar state. To us, this translates to the usual cycle getting pushed out further while we line the pockets of totalitarian regimes. Surely, some of these policies need a re-think, but I suspect that will take years, not months.

Consequently, we own far more resource based companies than we did a year ago and I expect that to continue in the months and years ahead. A number of clients have asked me about my bullish view on Canada given our federal government’s apparent hostility towards some of the cleanest fossil fuels produced on the planet. It is a fair question – I believe the market has already given us the answer. Not only has the Canadian market outperformed the US market in the first quarter of 2022, but Canada’s oil and gas stocks didn’t even blink when the latest round of federal emissions targets were released on March 29 by Environment Minister, Steven Guilbeault. Our take: the commodity prices trump the government’s current direction.

Summing it all up - we seem to be staring an economic slowdown and or possible recession, in the face, so what are we to do? First, let’s recall investment guru, Peter Lynch’s quip, “there is far more money lost preparing for the recession than during the recession”. In other words, slowdowns and recessions are part of the program, as are down markets. It is the price we pay for equity type returns. When tectonic market disruptions happen, we really don’t need to get rattled; we just need to recognize that there will be a lot of money made by recognizing the shift, and a lot of money lost for those investors that insist on clinging to what has worked over the last several years. If you are a student of history – and we are – and you have lived or studied such cycles – we have, then you at least have a compass to point you in the right direction. Our view has not really changed from my last report; what is good for resources, is good for Canada, and we continue to expect the Canadian stock market to outperform the US stock market in the months and years ahead.

With that, we are off to Track #3.

Track #3: Accessing Canada – Adaptive Tactics & The Q1 Recap

Most readers and listeners will know that within our core program, The Dividend Value Discipline™ (DVD), we have developed an adaptive approach to owning commodity related investments. In a nutshell, when market forces tell us we need to own them, we do, and when those same forces tell us to exit, we do. The latter was the case in January 2020 when we exited our oil and gas investments as the world was learning of the Covid 19 virus. We had no idea oil would go to zero, but the system that our sleuth analyst, Alex Vozian, CFA, had put together and back tested extensively, told us to sell. Thank God I listened to Alex and the system. Today, we are also listening to the system – to wit, within The Dividend Value Discipline™ - Equities Only strategy we have ~ 30% exposure to the energy and materials complexes. That compares to almost zero in March of 2020. As most of you know, The Dividend Value Discipline™ (DVD) was designed to be a bellwether strategy; a process that would allow us to do well over longer periods of time and one that could adjust to the cyclical opportunities as we move through the decades.

Turning to our complementary strategies, when we started to see the green shoots of the next bull market in commodities develop in late 2019 and early 2020, green shoots that promptly got mowed down in the initial months of the pandemic, we were already thinking about how to take advantage of the upcoming cycle. The first strategy we launched was The Next Cycle Resource Fund, which is not my first choice for most clients. It just too pure a play and, while the results have been great, I recognize that they won’t always be that way and that even the whiff of a recession will hit this program hard. The better choice for most of our clients is a sleeve of our Keep More Income strategy. It is all Canadian, all dividend paying, which makes it especially attractive for non-registered accounts, and yes, like Canada, it does have a higher exposure to resources. At the time of writing, we were at ~ 50% in energy and materials, so our counsel is, let’s not overegg the pudding.

In a similar vein, our Global Active Macro ETF (GAME) strategy has “pushed” us into more commodity type investments and commodity producing jurisdictions; Canada is now 60% of the program versus none a year ago.

What I want you to take away from this recap is that we have developed processes within our core and complementary strategies to take advantage of the opportunities presented over all market cycles. When commodities and commodity producers do well, most other companies struggle and the converse is true as well; these adaptive processes help us exit those areas of the market where we just should not be.

Turning to the progress recap, for those of you in audio only mode, our internally managed investment strategies for the three months ended March 31, 2022 are as follows:

|

Strategy |

2022 Q1 |

2021 |

|

The Dividend Value Discipline™ (balanced - ~ 75% equities/25% fixed income) |

-3.2% |

+25.7% |

|

The Dividend Value Discipline™ (equities only) |

-2.3% |

+33.3% |

|

The Global Active Macro ETF (GAME) Strategy |

+0.3% |

+18.0% |

|

The Keep More Income (KMI) Strategy |

+13.3% |

+25.9% |

|

The Tax Advantaged Preferred Share (TAPS) Strategy |

-1.0% |

+11.0% |

|

The Next Cycle Resource Fund (NCRF) |

+28.2% |

+43.7% |

|

The Fixed Income Cheap and Cheerful (FICC) |

-7.5% |

+4.7% |

Please note those figures do not include the returns from the non-discretionary side of your accounts. For most of our clients, that is the ultra-conservative side, i.e., the guaranteed investment certificates (GICs) and the inappropriately named high interest savings accounts (HISA). Obviously, the latter will have the effect of reducing household returns but please be reminded they do serve an important purpose. They ensure that we don’t have to sell securities in a down market to meet your cash flow requirements. Furthermore, the above numbers are only applicable to those accounts we manage within the Raymond James Ltd. (Canada) platform. Our cross border clients who have accounts domiciled at Raymond James USA Ltd. will have different results, in large part due to currency swings. As you know, the timing of cash flows and our buys only approach for new money translates to considerable variability in actual client experience. For your awareness, the March 31, 2022 statements are now up on your client login site. If you are not using that site, please reach out to us so we can get you up and running. We will kill less trees, it has 24/7 access and is far more secure than email.

That concludes Track #3.

Track #4: 7 Provocative Questions & A Shifting World Order

While disruption is the overall theme of this recording, we feel the need to dig deeper and consider what is causing the disruption because it helps us prepare for the future.

Over the last couple of months, I have spent a lot of time researching/thinking about how our global policy decisions affect our world. My conclusion is that in many cases, good intentions turn out to have some dire consequences, because we don’t consider the second, third and fourth level impacts. Democracies are particularly vulnerable to this behaviour because politicians can’t see beyond the next election cycle; in essence, they trade short term gain for long term pain. To demonstrate this phenomena and to give you some insights into things that concern us, what follows are some provocative questions and they come with a warning – there are no easy answers. Here goes:

- Did leaving the option of the Ukraine joining NATO on the table, incent Putin to invade? Is it not akin to having China develop a military alliance with Mexico, or the Cuban missile crisis?

- Did Europe’s fast track agenda to convert to solar and wind, create a dependence on Russia for its oil and gas and thus embolden Putin?

- Canada produces some of the world’s most environmentally responsible oil and gas. Did our decision to curtail production by killing pipeline and LNG proposals help the world’s environment or merely just push production to less environmentally responsible jurisdictions?

- Did the US’s decision to cancel the Keystone XL pipeline, just allow lesser environmentally concerned jurisdictions like Russia, Saudi Arabia and Iran to increase their production and pocket the cash?

- Did the copious amounts of money created out of thin air by central governments during Covid plant the seeds of our economic malaise in the years to come?

- Will the trade embargoes imposed on Russia and the retaliatory export ban by Russia on their wheat and fertilizer just plant the seeds for a famine in Africa next year?

- Did the US’s freeze on Russia’s ability to trade in USD$’s just push Putin towards China and thus put the US in jeopardy of losing its favoured world currency status? Should Americans be concerned about that?

On the latter point, I think we all should be concerned because it pushes us further along a path towards an America/China showdown, as laid out in Ray Dalio’s seminal book, Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail.

If Dalio’s name rings a bell for you, it is because he has been the source of lot of our learning on multiple fronts, and is part of the reason why we are profiting from the commodities boom today. In his latest treatise, he lays out why great powers rise and fall, and why history is bound to repeat itself. It happened to the Dutch; it happened to the British, and arguably, it is happening to the Americans today with China biding its time. A changing world order has obvious implications for protecting and growing our wealth – the first step in the process is understanding how these cycles work. If this intrigues you at all, then I highly recommend the book and if you would sooner listen than read, then Dalio has done an excellent 45 minute video, where he unpacks his concepts. Please recognize, these things take years if not decades to unravel and thus we have time to adjust incrementally as the future is revealed, in much the same way we are taking advantage of the present day opportunities.

Now for the wrap up:

- Please be reminded that the opinions expressed are mine, they may differ from Raymond James Ltd and undoubtedly, some of them are going to be wrong. It is just a natural outcome of this business. When we are wrong, we fess up and move with the evidence.

- On Track # 2: The Markets – Disruption! – yes the huge commodity price increases we have seen over the last quarter could be pushing us towards an economic slowdown or even a recession, but let’s recall that there is generally more money lost preparing for a recession, than during a recession. Down markets are part of the price we pay for equity type returns.

- On Track # 3: Accessing Canada – Adaptive Tactics & The Q1 Recap, is where I walked you through our adaptive tactics both within our core investment strategy, The Dividend Value Discipline™ and our complementary strategies, that not only allow us to do well over longer periods of time but take advantage of the cyclical opportunities as we move through the decades. The take away is that this is not a static process.

- On Track # 4: 7 Provocative Questions & A Shifting World Order, is uncomfortable to say at the least – just because we don’t like the possible outcomes, does not mean they can’t happen. We need to think about such things to grow and protect your wealth.

- Track #5: Postscript I – Our Approach is for the benefit of prospective clients. It will give you some insight on the new client process through which we walk interested parties. Spoiler alert – it starts with you and your story - our approach is tailored to your “do, have, and legacy” ambitions. In short, we need to understand your aspirations before we can help you achieve them.

- On Track #6 Postscript II is where I walk you through the methodology and return objectives of our core program, The Dividend Value Discipline™. If you have an interest in the specifics of our core investment process, you will probably get a lot out of it; if that’s not you, you may want give it a pass.

That brings us to a close for this edition of The Quarterly Opportunity Update. A reminder, if you are being introduced to us by way of this recording, then Tracks #5 and #6 are for you. Thank you for taking the time to listen. If you have people in your life who you think might benefit from these missives, please forward them as you see fit. Alternatively, they can sign up through our website, where all that is required is a first name and email address. Alternatively, they can book some time at Book Appointments. This is Chris Raper, cofounder of Aspira Wealth, wishing you and your loved ones all the best - good day and may God bless from Victoria B.C. on Thursday, April 7, 2022.

Track #5: Postscript I – Our Approach

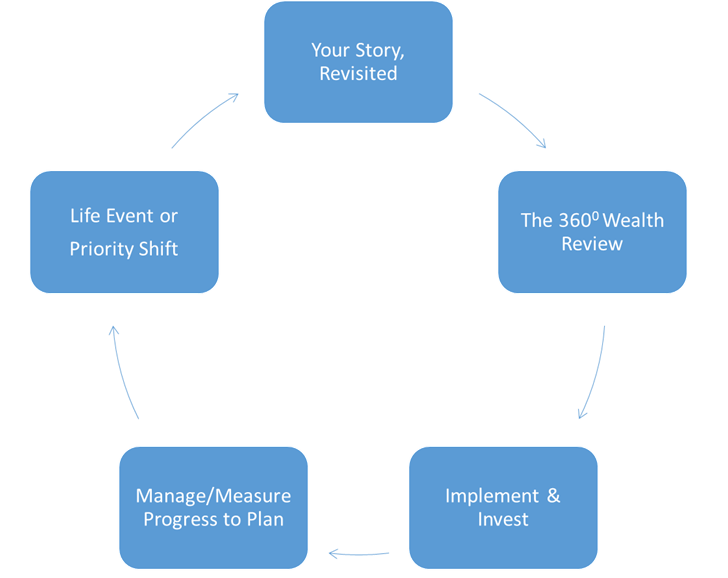

While this recording has been focused on investments, that is not where we start with new relationships. We start with your story, and we revisit it often. Knowing where you came from and what you want the future to look like – your do, have, and legacy ambitions – is the foundation for building a solid client/wealth advisory relationship. Our first order of business is to listen, seek clarity and then document your ambitions for the future – we call it, Your Story, Revisited.

From there, we complete a 360⁰ review of all relevant investment, tax/estate and insurance documents in an effort to identify gaps/risks to the future you envision. When we identify holes, we have a discussion about how we might fill those holes.

Then and only then do we get into a discussion on the investment allocation. We will address your liquidity, income and growth requirements/desires, and introduce you to tax smart investment strategies to meet those needs.

After we invest, it is a matter of manage and measure – we report regularly, and when life throws you the inevitable curve ball or your priorities change, it is back to revisiting your story.

In summary, we learn about you, your family, your finances and what your ideal future looks like – the things you want to do, the things you want to have and the legacy you want to leave. We identify the structural risks and how we see mitigating them. We paint a go forward picture with a worst case analysis of the costs involved.

Generally speaking, we are looking to establish relationships with new clients that have north of $1 million in investable assets, but please understand that we are a lot more interested in where you are going than where you are. If you have a credible plan to get to that number, say within a three to five year period, we are very interested in meeting with you.

So…if that process sounds engaging, I invite you to call and book some time. If you’d like further information, including access to our quarterly communication pieces, you can check us out on the web at www.aspirawealth.com and send us an email from there.

Track #6: Postscript II – The Dividend Value Discipline™ Methodology

The first thing I want to share with you is that The Dividend Value Discipline™ is our core mandate – essentially, all of our clients have a slice of their portfolio allocated to it. For your awareness, we currently have several strategies that we manage in house, in addition to a short list of 3rd party money managers. Structurally, most clients have three buckets of money with us – a safe money bucket, an income bucket and a growth bucket. The Dividend Value Discipline™ straddles the latter two and depending on your needs, we augment it with other strategies. The program continues to be a large slice of our client assets under management and, in my case, it is by far the largest.

The process is discretionary, meaning we make all of the buy and sell decisions and report to you after the fact.

Our objectives for the program are:

- Income every month – that can be paid out or be reinvested;

- An acquisition process where we buy only those securities which become attractive on a “go forward” basis;

- Absolute returns of 8%+ over any investment cycle, which we would describe as peak to peak or trough to trough. If you are looking for a time frame in terms of years, think 5+ years, but please understand investment cycles have a wide range of timeframes.

The program operates with three key elements and I will walk you through them using the illustration of a three legged stool.

The First Leg is Dividends

With few exceptions, every security that we buy must provide some form of income. We do that because income makes portfolios inherently less volatile, i.e. less chance of loss. The analogy I like to use is that of an apartment block versus a piece of raw land – it is a lot easier to hold on to an apartment block in a tough real estate environment when you are getting a rent cheque every month. Income drives stability and absolute returns.

The Second Leg is Value

Our research function is in house. When we launched the program back in September of 2002, we were one of the first private client teams in the industry to have a dedicated analyst on staff and we add additional resources every year. We spend an inordinate amount of time studying the corporate culture of potential investee companies. If you are interested in what great corporate culture looks like, I encourage you to read Good to Great by Jim Collins – that is the yardstick we use to measure potential investments. Another yardstick is the importance of wide economic moats – the things that make a company tough to compete against. We want to own companies that the end client can’t live without – great examples might be Microsoft or Intuit, both long term holdings of ours. We believe that the focus on great corporate culture and wide economic moats gives us an edge, and while I can’t prove it you, I can certainly give you lots of anecdotal evidence to support that thesis.

The more recent development in our strategy has been tackling the growth problem. History buffs will note that when we started the program in 2002, we had 5-year GICs yielding roughly 5% and much better economic growth; whereas today, we have 5-year GICs yielding of ~1.5% and much slower economic growth. In short, the 8% is tougher to come by.

Accordingly, we spent late 2015 and 2016 tackling the growth problem. We needed to find companies that were growing far faster than the economy. As you would expect, we started within the normal confines of “has to pay a rent cheque, score well on the corporate culture front and have some sort of strategic advantage (moat) that makes the company difficult to compete with.” We then focused on those companies that have demonstrated their ability to grow their earnings/dividends at double-digit rates as a primary indicator of income growth and capital gain potential. As we searched, we found that most such companies fell into one of two themes. They tended to be disrupting the existing marketplace (think Wal-Mart 20 years ago or Amazon today) with a better way of doing things, and/or they tended to be aggregating their way to growth by buying smaller tuck-in acquisitions, much like Constellation Software Inc.

The Third Leg is Discipline

Here I refer to the buy/sell decisions.

On the buy side, I would sum it up as “do your homework, be ready, be patient”. Over the years, our absolute best buys have been when we have done our homework on the company, perhaps months before, and then some untoward event happens that gives you opportunity to buy in size. The Euro debt crisis in 2011 is a great example that enabled us to buy Nike at a terrific price because we were ready and we had conviction. More recently, I would put the world’s #3 French fry maker, Lamb Weston, in that category.

Sell decisions are getting increasingly tougher because the quality of our companies just keeps going up, and with their rent cheques (dividends) growing at double-digit rates, our history tells us more often than not that we are better off holding than chasing shiny baubles. That said, new competitors with disruptive technologies can wreak havoc on a company’s growth prospects – back to the Amazon/Wal-Mart example. Transition periods of senior management teams can be risky, especially when there is no hire-from-within bias. Then there are times when the price of a stock just gets so far in front of its growth prospects that the only reasonable thing to do is sell. As Buffett likes to say, “You pay a high price for a rosy consensus”. When things are universally rosy, we try to be sellers, not buyers.

Perhaps the most important part of the buy/sell discipline is the way we operate the program for new entrants – we call it “The Buys Only Mandate”. Unlike most of our competition, we only buy those securities which become attractively priced on a go-forward basis; meaning if you start today and your brother starts three months from now, your portfolios are going to be different in the short-term, and more closely aligned the longer you are in the program together. As rational as that might seem, most people do the exact opposite. Every time you buy a mutual fund, you buy a pro-rata share of an existing portfolio – by definition, you got the buys, the holds and the near sells. To us, that is not rational. Who buys 100+ companies in a single day? Were they all great value propositions? You should also be aware that most third party money management programs work exactly the same way – they buy the basket. The buys only mandate was designed to protect your hard earned money.

The information contained in this report was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete and it should not be considered personal tax advice. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views expressed are those of the author and not necessarily those of Raymond James. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd., Member—Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd. is a member of FINRA/SIPC.